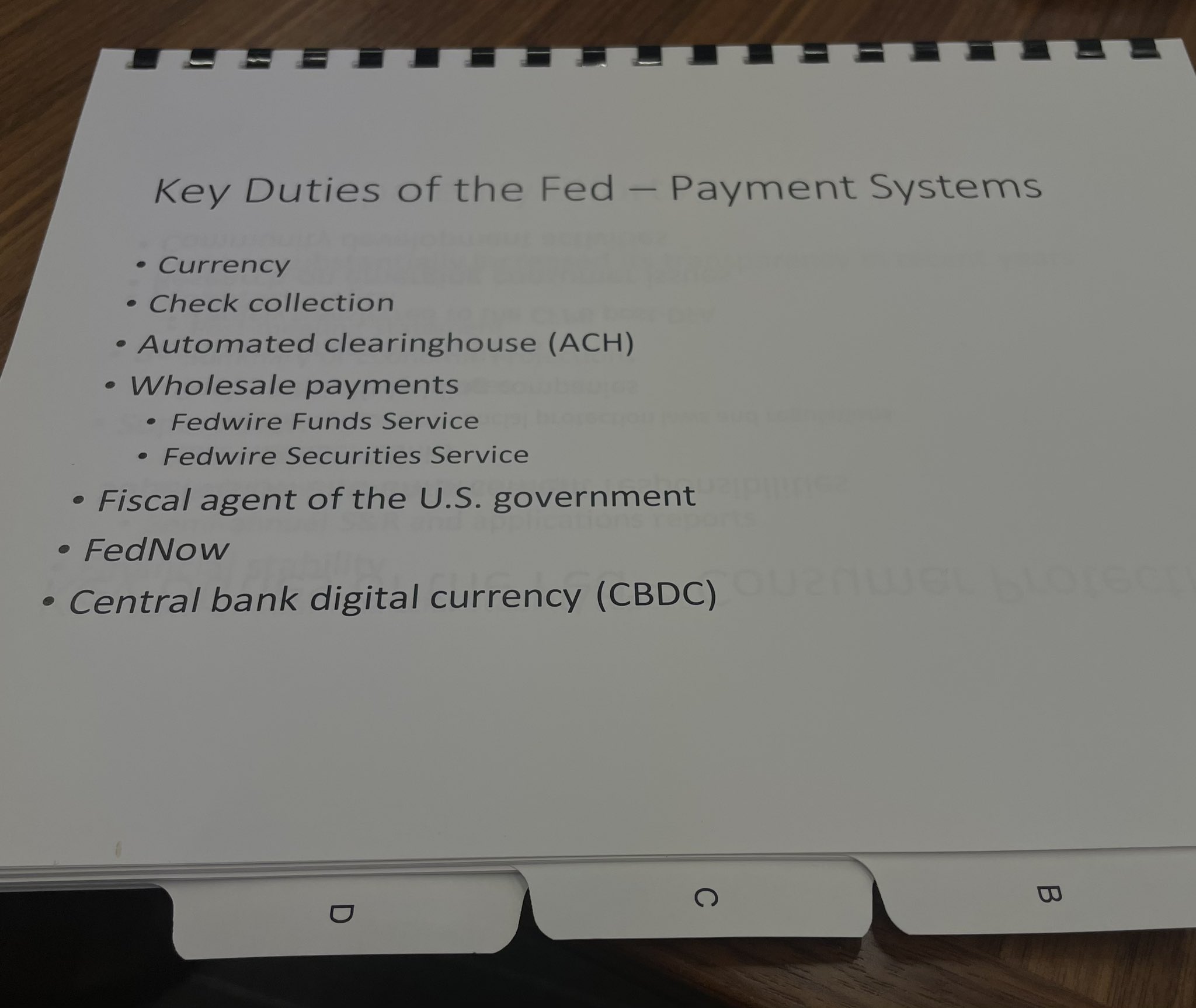

The U.S. Federal Reserve has identified the development of a central bank digital currency (CBDC) as a crucial responsibility in a document presented to members of Congress. House Majority Whip Tom Emmer, a Republican from Minnesota, revealed that Fed officials provided his staff with a document outlining the “Key Duties of the Fed – Payment Systems” during the Congressional session.

Emmer, known for his support of cryptocurrencies but skepticism towards CBDCs, emphasized the Fed’s interest in pursuing a CBDC by stating, “If you don’t think the Fed is pursuing a CBDC, think again… They view a CBDC as one of their KEY DUTIES.” Despite this revelation, Fed Chair Jerome Powell recently testified to Congress that there are currently no plans to implement a CBDC in the near future.

Powell explained that while money has increasingly become digital, the Fed is not actively recommending or adopting a CBDC at this time. He also reassured that any potential CBDC would not allow the government to monitor individuals’ financial transactions, citing concerns about privacy and drawing comparisons to China’s digital currency system.

The news of the Fed’s consideration of a CBDC has sparked discussion among experts and stakeholders in the financial sector. As technology continues to evolve, the idea of a digital form of government-backed currency is gaining traction, but the specifics of how a CBDC would be implemented and regulated remain unclear.

Overall, the debate over a potential CBDC highlights the ongoing evolution of the financial landscape and the need for careful consideration of the benefits and risks associated with digitizing national currencies.