A bank routing number is a crucial nine-digit code that identifies a financial institution, such as a bank or credit union, for electronic money transfers, online payments, and direct deposits. Also known as a routing transit number (RTN) or an ABA routing number, this unique code, when combined with your account number, directs financial institutions on where to withdraw or deposit funds accurately.

While some smaller banks may have only one routing number, larger institutions may have multiple ones. At big banks, your account’s routing number typically depends on where you initially opened the account. Think of it as a zip code for your money, ensuring it goes to the right place.

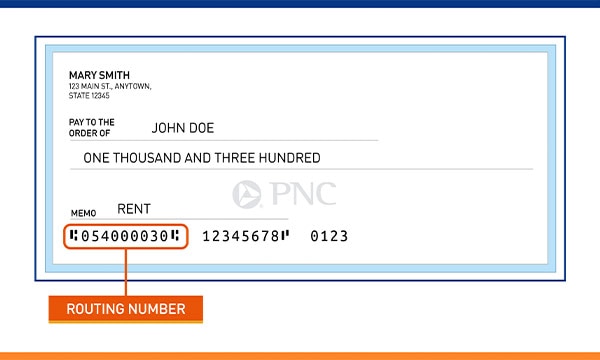

Knowing your bank’s routing number is necessary when setting up electronic transfers for paychecks, tax refunds, or online payments from a checking or savings account. This number can be found on the bottom left-hand side of a paper personal check, along with your account number and check number.

If you don’t have a check available, you can also find your bank’s routing number through online banking, mobile apps, or on your monthly bank statement. The American Bankers Association (ABA) also provides an online lookup tool for finding routing numbers, with limits on usage.

Understanding and having access to your bank’s routing number is essential for seamless electronic transactions. Whether setting up direct deposits or making online payments, having this information on hand ensures that your money moves to the right place at the right time.