Monero (XMR) has shown resilience by maintaining gains above the 0 support level and has recently gained momentum. The cryptocurrency has been able to sustain its gains near the 100-day Exponential Moving Average (EMA) mark.

A notable double bottom formation has been observed, with a neckline resistance around 0, close to the 200-day EMA mark. If the bulls manage to break through this range, a significant bullish rally could be on the horizon.

Currently, XMR is trading at 3.56, experiencing a slight intraday drop of 1.89%, indicating a state of neutrality. The cryptocurrency has seen a monthly return of 16.20% and a yearly return of 13.20%. The XMR/BTC pair is at 0.00217 BTC, with a market cap of .47 billion. Analysts are neutral on XMR’s price action, foreseeing a potential bullish momentum that could see the price surpass the 0 mark.

In recent news, LocalMonero, a peer-to-peer trading platform, announced the shutdown of its platform, causing a surge in Monero’s price by over 17% in the last 10 trading sessions. The closure of LocalMonero has sparked interest and buying activity in XMR, with the cryptocurrency showing signs of buyer accumulation.

The price action for Monero has been hinting at a potential trend reversal, as it approaches the 200-day EMA mark and the 0 resistance level. Despite previous lower lows, a fresh wave of bullish sentiment has emerged in the market.

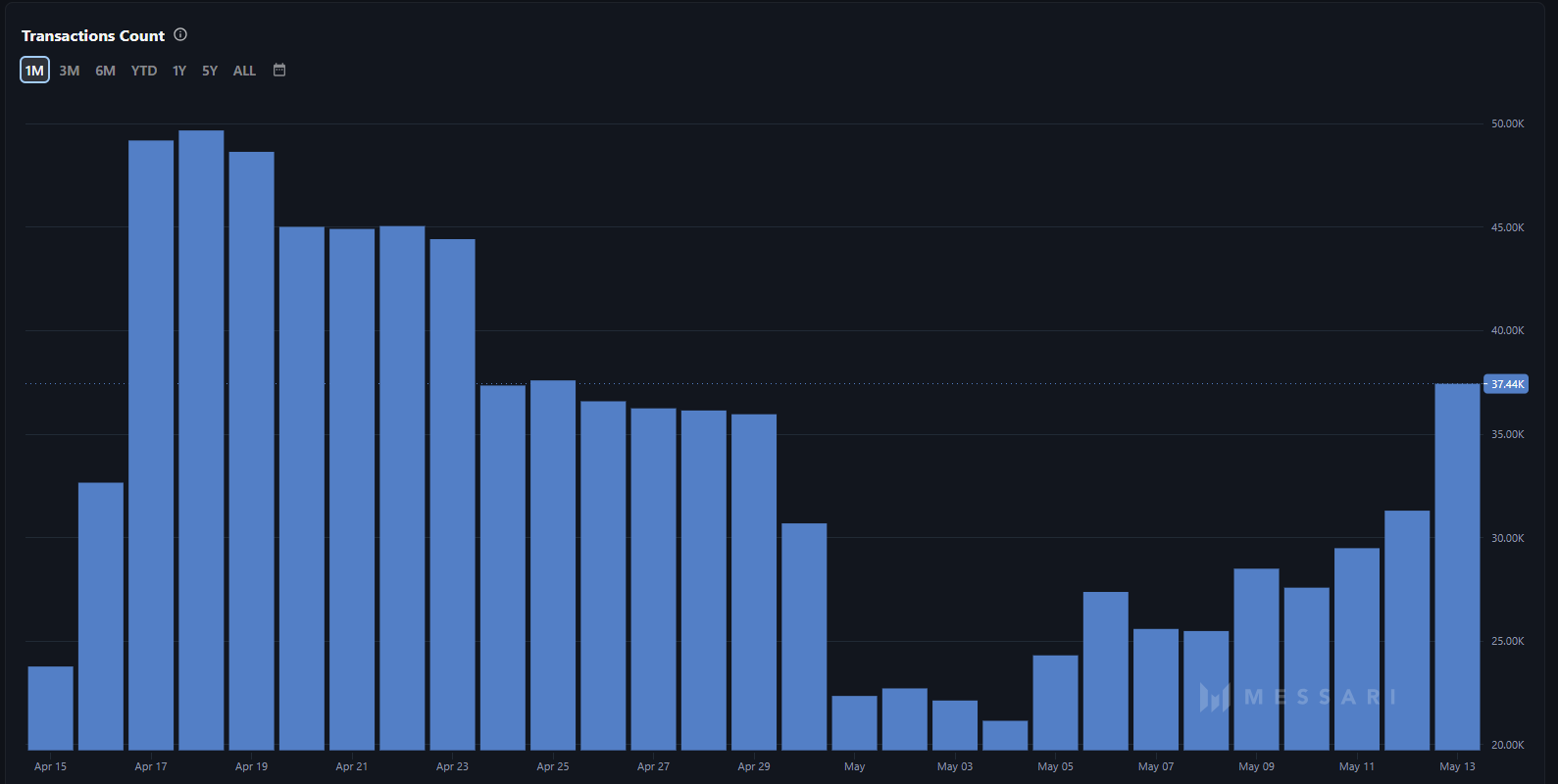

The transaction count for Monero has significantly increased, indicating growing interest and activity in the cryptocurrency. Additionally, futures data suggests short covering by sellers, further supporting a positive outlook for XMR’s price.

Looking ahead, XMR has immediate support levels at 8 and 0, with key resistance levels at 0 and 0. The cryptocurrency is poised for a potential breakout above 0, with increasing buying volume and enthusiastic buyers entering the market.

In conclusion, Monero (XMR) is showing signs of a bullish trend reversal, with the potential to surpass the 0 mark in the near future. Investors should exercise caution and conduct their own research before making any financial decisions based on this information.